Doing Business in Honduras

By Diego Reppas | June 15, 2021

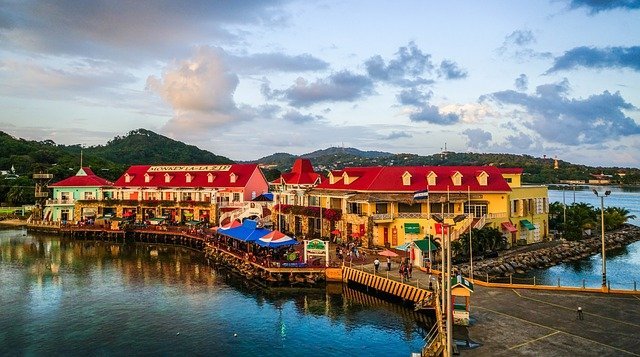

The official name is the Republic of Honduras. This Caribbean country is located in Central America, so its strategic position places the country as one of the best commercial options between the North and South of the continent. Honduras is privileged because it is located between the Atlantic Ocean and the Pacific Ocean, in addition, due to its location it has several ports among which Puerto Cortes and Puerto Castilla stand out for being depositories of deeper waters that allow the berthing of ships of great depth.

In terms of air facilities, Honduras has the largest number of airports certified as international in the Central American region. Palmerola Airport is currently under construction, which is projected as a more strategic airport that due to its geographical location, will allow a greater movement of people.

Legal framework

Any entity that carries out commercial operations in Honduras must carry out the necessary procedures before starting its commercial activity, likewise, it must make the corresponding registration and inscriptions in the Mercantile Registry. In Honduras there are different forms of incorporation for commercial companies, the types of companies that are generally constituted in Honduras are the Limited Liability Company and the Public Limited Company.

An important registration that companies must make is the registration in the Mercantile Registry since it is necessary for their registration in the Tax System of the country and obtain their National Tax Registry which is a public document that is used to carry out economic transactions and tax procedures. Subsequently, the company must obtain its operating permit which is a document that is extended by the Municipal Mayor’s Office of the domicile of the company to ensure that the company operates in accordance with municipal laws.

According to its commercial activity, the company needs other special permits such as:

- Environmental License,

- Registration of Trademarks and Patents,

- Health license and records,

- Bar Code,

- Registration in the Chamber of Tourism,

- Permits for Representatives, Distributors and Exclusive Agents,

- Export Permit, and

- Permission to import products of plant and animal origin.

Tax System of Honduras

Honduras’ tax system operates under the principle of territorial income as of January 1, 2017 with the entry into force of the new Tax Code. The Honduran tax system establishes two types of tax obligations:

- Formal tax obligation: this obligation is intended to present those documents that give validity to the tax act such as the presentation of affidavits.

- Material tax obligation: this obligation is nothing other than the payment of the returns that by law taxpayers are obliged to file.

The first tax obligation that any legal entity that performs acts of commerce is the obligation of the National Tax Registry (RTN). This document is the mechanism used to identify, locate and classify natural or legal persons, with administrative obligations and controlled by the Revenue Administration Service.

Free Zones

In the update Honduras has several special regimes allowing foreign investors to benefit from tax benefits. Likewise, in the free zone, operations and activities can be carried out to: introduce, remove, store, handle, pack, display, pack, unpack, buy, sell, exchange, manufacture, mix, transform, refine, distill, assemble, cut, benefit and in general operate all kinds of goods, products and raw materials, packaging and other trade effects. Operations, transactions, negotiations and permanent or incidental activities related to the establishment and operation of the same may also be carried out.

Recently in 2020 a tax reform was made to the Law of Free Zones; the main objectives of the reform are:

- Simplify the processes and procedures for the approval of companies, national or foreign, that want to benefit from the Law of Free Zones.

- The benefits of the law to 15 years, extendable for a further 10 years.

- The coverage for the nationalization of products will be 50%, currently, it is free, to achieve fair competition for domestic producers.

- Companies, both national and foreign, that seek to benefit must make the procedure only before the Secretariat of Economic Development.

If you have queries in relation to doing business in Honduras then contact our Honduras business specialist Carlos Alberto Galindo at honduras@d-b-in.com

Latest Articles

-

Exploring Brazil’s Potential as a Business Destination

March 10, 2025

-

Navigating the Complexities of Mexico-U.S. Trade Relations

March 10, 2025

-

Why Brazil Is a Strategic Choice for International Investors

March 9, 2025

-

Establishing a Business Presence in Mexico: Key Considerations for U.S. Companies

March 9, 2025

-

Navigating Corporate Taxation in Denmark – A Guide for Businesses

March 8, 2025